SOLUTIONS

OWIT's Solutions are intelligent, targeted, and easy to maintain.

Our solutions are managed through a no-code, drag-and-drop tool and utilize APIs for rapid integration.

Insurance Data Management

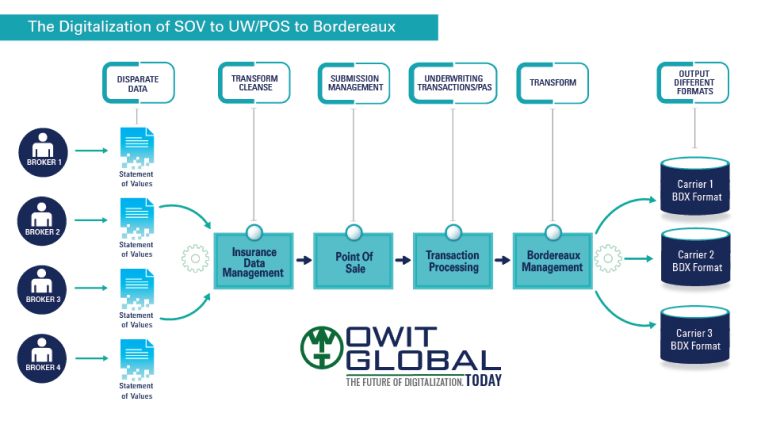

A central feature of the O/DIEM platform, the Insurance Data Management (IDM) Solution is designed to support the ingestion, cleansing, normalizing, and processing of all insurance data of any data interchange including Bordereaux, Statement of Values, and Delegated Underwriting.

IDM can be leveraged for both incoming and outgoing data, supporting an insurance entity’s entire ecosystem.

IDM includes specific insurance features and functions to support the processing of insurance data.

IDM is designed for the insurance-knowledgeable Business Analyst to quickly deal with data transformation needs versus relying on a technology department queue.

IDM leverages Chat GPT v4.0 to provide a range of AI functions. IDM AI capability is available today with additional capabilities being added on a continuous basis.

Bordereaux Management

Binder Management

Delegated Underwriting Management

Statement of Values Consumption

Process Efficiencies

OWIT’s digitalization experience includes data integrity and efficiency of process through solutions that deliver Broker Portals, Submission Management, Point of Sale, Rating, Rules and Document Generation.