OUR DIGITALIZATION VISION IS

STRAIGHTFORWARD

CLEAN DATA & PROCESS MODERNIZATION

ASSISTED BY ARTIFICIAL INTELLIGENCE

Frictionless Commerce

OWIT Global offers every insurance-related company, be it carrier, broker/agent, reinsurer, MGA/MGU, and TPAs, the ability to access and manage its data quicker, more accurately, and more productively.

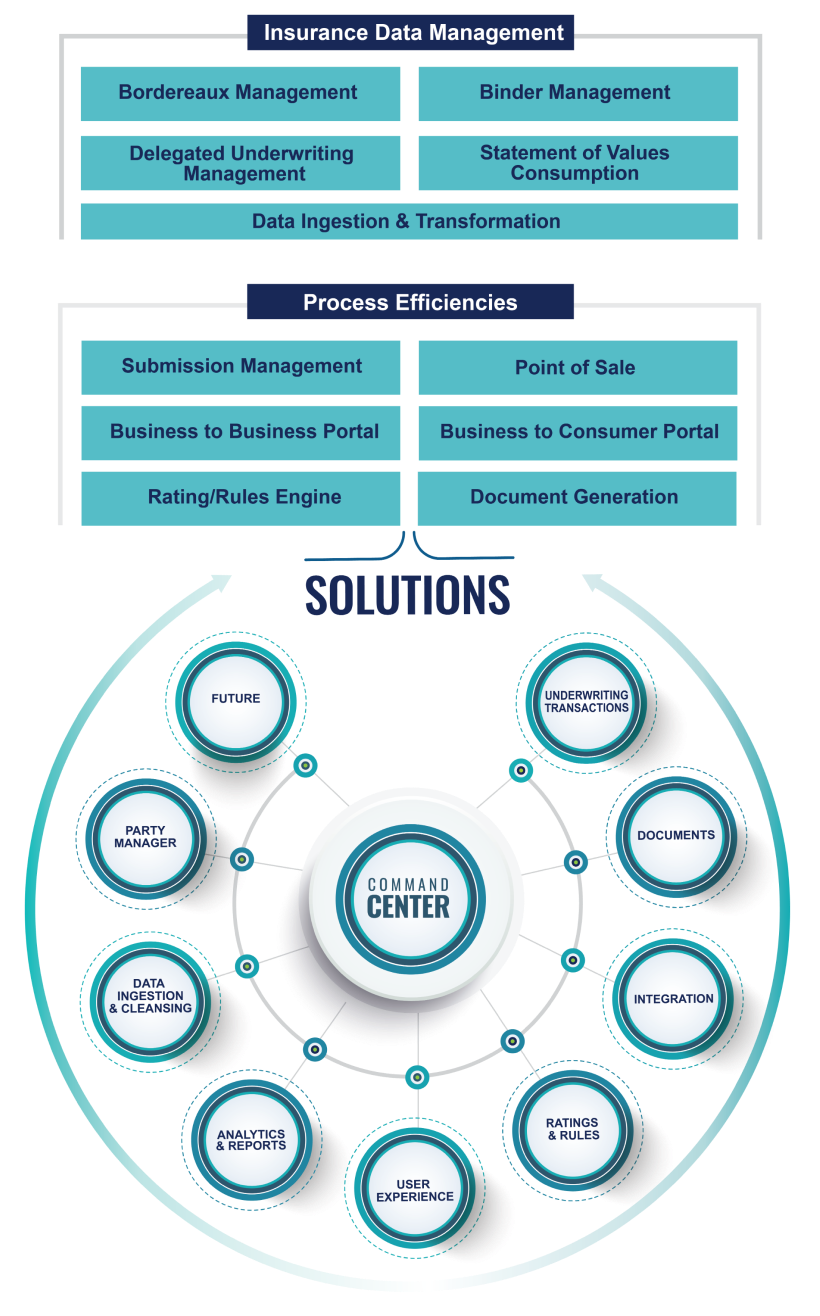

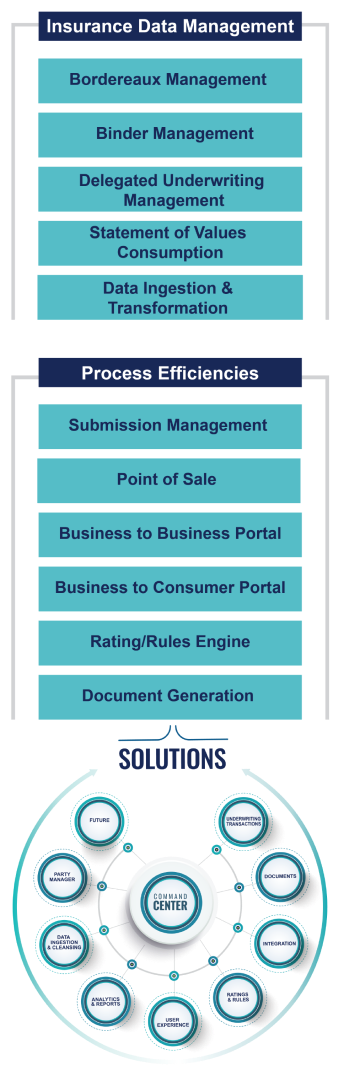

OUR SOLUTIONS

Insurance Data Management, Bordereaux Management, Delegated Data Management, Statement of Values Consumption, B2B and B2C Portals, Document Generation, Submission Management and Point of Sale to name a few.

OUR RESULTS

Better Business Decisions & Processes

With clean and transformed data combined with modernized processes, the OWIT Solutions have provided the industry with reliable information and straight through processing.

The Industry Turns to OWIT Global

Leveraging our knowledge, OWIT has created a master platform that gives you total control to collect, cleanse, utilize, and distribute the data to various counterparties. Leveraging the focused application of AI accelerates the onboarding and processing of this data.

OWIT Global’s core offering provides all insurance entities, be it carrier, broker, reinsurer, MGA/MGU, or others, with a strategic platform that gives the company total control to collect, cleanse, utilize, and distribute data to various counterparties. Leverage OWIT’s Digitalization Insurance Enterprise Management Platform (O/DIEM) to process all of your data, resulting in clean and validated data for your enterprise. O/DIEM supports your bordereaux data, any other internal or external data transfer, and any data that runs through OWIT’s other solutions, such as Broker Portal, Point of Sale, and Document Generation, thereby extending your existing system investments.

We support the insurance industry’s need to

reinvent and improve processes

The OWIT portfolio is built on a Digitalization Insurance Enterprise Management platform (O/DIEM) to support the insurance industry’s need to reinvent and improve processes and its need for clean data across the value chain.

O/DIEM works seamlessly with OWIT’s Delegated Data/Bordereaux/Binder Management solutions, as well as other solutions such as Broker Portal, Point of Sale, Rating, Rules, and Document Generation.

O/DIEM can also connect to a customer’s existing environments to enable the transformation (cleanse and normalize) of data and digitalization processes.

CONTACT US TODAY

GET IN TOUCH

433 South Main Street, Suite 106

West Hartford, CT 06110

833-GET-OWIT

Quatro House Frimley Road,

Camberley GU16 7ER

+44 (0) 1276 804430

9th Floor, Unit No. 2 (West Wing)

Kapil Towers, Financial District, Gachibowli

Hyderabad, 500032, Telangana, India

+91 98205 26995